Chapter 13 Bankruptcy in Maricopa County

Scottsdale Chapter 13 Bankruptcy Lawyers

If you are considering filing for chapter 13 bankruptcy in Scottsdale, Arizona, our Scottsdale bankruptcy lawyers may be of great assistance. Do you have a regular income but are experiencing severe debt problems? If so, chapter 13 bankruptcy might be the debt relief solution that you seek. Seek out the guidance of a chapter 13 bankruptcy attorney to find out if your particular situation may be right for debt relief protection of filing chapter 13 bankruptcy in Scottsdale, Arizona.

Bankruptcy filing rates in Scottsdale and throughout Maricopa County are on the rise. The 2 most common types of bankruptcy filed under federal law are chapter 7 and chapter 13 bankruptcy. If you are eligible for a Chapter 13, your unsecured debts, (such as credit card debt), are combined. A chapter 13 payment plan is created based on your disposable income. You don’t have to worry about this plan as you will still have enough money left over to make payments on secured debt, such as house and vehicle payments. Chapter 13 permits you to adjust your debts, retain your assets and pay off the money you owe, normally over a 3 to 5 year period.

There are several differences between Chapter 7 and Chapter 13 bankruptcy. If you are considering bankruptcy as a means to get out of debt, consult with an experienced Arizona bankruptcy law attorney. We can help you determine the chapter and best debt-relief action to take for your specific debt and case.

CHAPTER 13 bankruptcy FAQs

FAQs for Our Scottsdale Bankruptcy Lawyers

Chapter 13 Bankruptcy Attorney Serving Scottsdale and Phoenix

Scottsdale Chapter 13 Bankruptcy Lawyer

Our Scottsdale bankruptcy law firm helps clients in Scottsdale, Phoenix, and throughout Arizona make informed decisions about their financial future. Our Scottsdale bankruptcy attorneys will go over all of the details of your debts to help you figure out whether filing for chapter 13 bankruptcy is the best option or if there are alternatives to filing bankruptcy that may be more appropriate. Our Scottsdale debt relief experts can immediately help stop creditor harassment and constant phone calls, which is generally well known when people are behind on their bill payments.

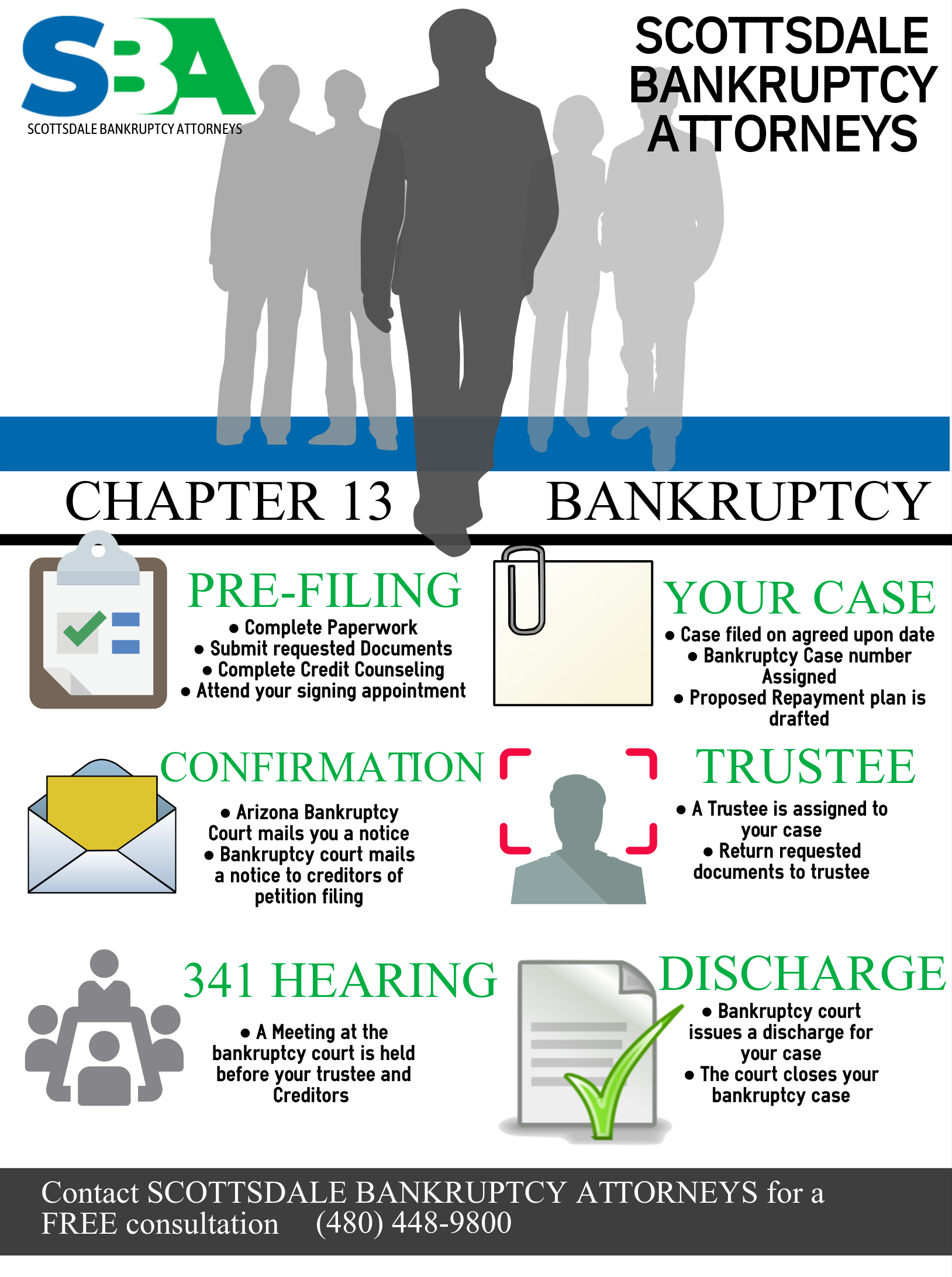

We will discuss your options during initial consultation and provide you with simple information that explains the bankruptcy process. If it is decided that Chapter 13 is the best route, our approach is very streamlined. There are no lengthy forms to fill out and you will know exactly what to expect in the coming weeks, months and possibly, years. Our Scottsdale chapter 13 bankruptcy lawyers are very experienced in handling chapter 13 bankruptcy filings. We get our plans confirmed quickly and guide you through the whole process of filing chapter 13 bankruptcy and financial freedom.

Contact one of our Scottsdale chapter 13 bankruptcy attorneys from our Scottsdale bankruptcy law firm now to set up a free consultation to go over your options. Call (480) 833-8000 for a free consultation and debt evaluation.

Bankruptcy Attorney Firm 5.0 Star Rated on Avvo

Low Fee

Guarantee

File With

$0 Down

Free Case

Consultations

4 Convenient

Locations

Payment Plans

Available